What is a Cap Rate and How is it Calculated?

If you have researched investment properties, you have probably heard the term CAP rate. CAP stands for capitalization and is often used to determine the value of income-producing real estate. The cap rate is a measure of what the returns will be assuming you pay cash for a property. The CAP rate will not give you the returns when you have loans on properties, but it will give you an idea of what a property is worth.

If you have researched investment properties, you have probably heard the term CAP rate. CAP stands for capitalization and is often used to determine the value of income-producing real estate. The cap rate is a measure of what the returns will be assuming you pay cash for a property. The CAP rate will not give you the returns when you have loans on properties, but it will give you an idea of what a property is worth.

InvestFourMore Cap Rate Calculator

If you are involved in commercial real estate, it is vital that you understand CAP rates and how they work. It is also vital that you know what CAP rates are in your area. CAP rates can be used to trick people into thinking a property is a better deal than it is. Plus, incorrectly figured CAP rates can provide amazing opportunities for investors.

What is a CAP rate?

The CAP rate is a common figure used to determine the value of a commercial rental property. The CAP rate basically tells you how much a property will make if you pay cash for it. If you buy a property for $1,000,000 and it makes $70,000 (7% return) a year, the CAP rate is 7%. If the property makes $100,000 a year, the CAP rate is 10%.

Is CAP rate used for the value or purchase price?

The CAP rate can be used to determine the value of a property, the return of the property, and many other factors. The CAP rate can be used to figure out what a property is worth if you already own the property.

- I own a property that is making $100,000 a year and the market CAP rates for that property are 10%, so the property is worth $1,000,000.

When a property is for sale, the CAP is given based on the asking price and income.

- If someone needs to sell fast, maybe they advertise the above property for $909,000 as an 11 CAP. Or, if they are willing to wait for the right buyer, they list it at $1,100,000 and 9 CAP.

I could also buy the property for $1,000,000 when it makes $100,000 but add $20,000 in income. I bought the property as a 10 CAP, but after improving the income, it is now a 12 CAP based off the purchase price. I can say the property is a 12 CAP based on what I paid, or the property is worth $1,200,000 based on a 10 CAP now. Either way, both statements would be true.

Why CAP rates are important to real estate investors?

CAP rates are important because that is how most commercial properties are valued and advertised. If you want to invest in commercial real estate, it is important to know CAP rates, how they are figured, how they can be manipulated, and how they can make you money. Depending on your situation, they may not be the best way to judge how much money you are making.

I think cash flow or cash-on-cash returns are more important indicators on a rental property. Cash flow tells you exactly how much money you are going to make including expenses and debt service. The cash-on-cash return will tell you what percentage you are making on the money you have invested, which is much more important to me than cap rate.

The CAP rate is valuable as a tool to value properties and tell you what you should pay for properties, but it only tells you the return if you are paying cash. I prefer to leverage my money, so the CAP rate is not the best indicator of how much money I will make.

Cash on cash return calculator.

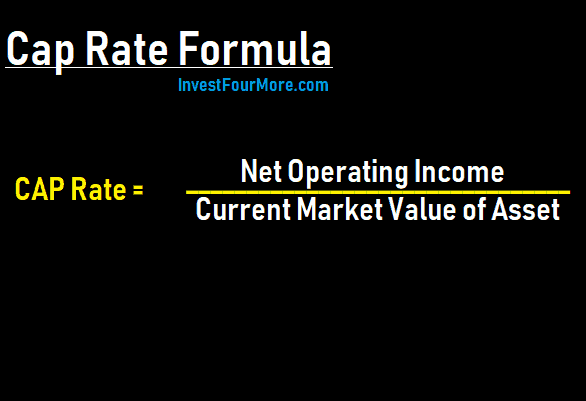

How do you calculate the CAP rate?

The higher the CAP rate, the more money the property makes based off the purchase price or the value.

The CAP rate calculation is very simple:

CAP Rate = Net operating income divided by the price of a property.

For example, if you buy a property for $100,000 and the net income is $10,000 a year, the cap rate is 10%. ($10,000/$100,000=10%) The cap rate can be figured out very easily, but the tricky part is knowing how accurate the income numbers are on a particular property. The net operating income is used to figure the cap rate, and that number can be easily manipulated.

You can easily figure the CAP rate using my CAP rate calculator.

Factors that affect the CAP rate

The net operating income, or NOI, is the money the rental property will make after accounting for expenses. Debt service is not included, but property management, taxes, insurance, maintenance, and other expenses should be included. The NOI can easily be manipulated because different investors will use different expense numbers. Some investors will include allowances for vacancies and maintenance, while others will not. If a property is self-managed, the landlord may not include any expenses for property management. Make sure you do not blindly trust NOI figures given to you!

You will find different investors include different expenses to determine the NOI. Some investors may include vacancies and property management, and others may not. Some investors may not include any maintenance in their NOI projections to make their properties appear more profitable. If you are basing a purchase decision on the cap rate, you need to make sure all expenses are accounted for. If the total rent for a property is $10,000 a year and the NOI is $10,000, there are obviously expenses being left out of the equation unless it is a true triple net property. A NNN lease is when the tenants pay all of the expenses. Although, even with a NNN lease, there are usually some additional expenses.

Here are other expenses that should be included:

- Property taxes

- Property insurance

- Property management fees

- Utilities paid by the landlord

- Ongoing maintenance paid by the landlord

- Vacancies

- Expected maintenance expenses

- HOA fees

- Any onsite management

- Tenant Improvements

Can you trust the CAP rate?

If the expenses and NOI are not figured correctly, it may show an inflated value based on market CAP rates. The higher the NOI is with the same CAP rate, the higher the value will be. It is easy to manipulate the CAP rate by fudging the NOI.

I never trust the numbers given to me by a seller or agent. I am not saying they always intentionally give bad numbers, but they might, or they may not even know how to figure the correct numbers. I verify the numbers with what I think the expenses should be, and I also try to see the actual expenses the seller pays. In most commercial transactions, the seller should be willing to give out those numbers, although they may require interested parties to sign a nondisclosure agreement, which means the interested parties cannot share those numbers.

What is a good CAP rate?

It is not easy to know what a good CAP rate is. The CAP rate is relative to many other factors like the location, the condition, and the use of a property. The condition and tenant also affect whether or not the CAP rate can be considered good. I personally want to see at least a 9 CAP on the properties I buy. These could be vacant properties or properties that need some work. After they are leased and repaired, I want at least a 9 CAP depending on how much work is needed. Properties actually sell at a 7 CAP or lower in my market, so I know I am in good shape and will be creating a lot of value by purchasing properties that will be a 9 CAP based on what I paid.

CAP rates in different areas of the country

Another tricky thing with CAP rates is they are not the same everywhere. The market determines what the CAP rate will be, and it varies greatly in different areas. In hot markets like Los Angeles, the CAP rates may be as low as 4%, while markets in the Midwest may see CAP rates of more than 10%. Different cap rates can change the value of properties by hundreds of thousands or millions of dollars.

For example:

- NOI: $100,000 a year with a CAP rate of 4% the value is $2,500,000

- NOI: $100,000 a year with a CAP rate of 10% the value is $1,00,000

The CAP rate varies based on the demand for an area, how stable the economy is, and what returns investors expect. Investors are willing to make less money in California relative to the cost of a property because they feel there is more upside for rent increases and rent appreciation. In areas with less stable economies, the rents may not go up or could even decrease. Higher risk means the landlords must make more money to make a purchase worthwhile.

CAP rates vary based on the type of tenant and building

CAP rates will vary in different locations and in the same location based on the tenant and the property. In my area, Northern Colorado, the CAP rate could be 5 or 6% on long-term tenants like a Wendy’s with a 20-year lease. The CAP rate rises to 7 or 8% for less stable tenants who may only have 1-year leases. If a property is vacant, the CAP rates rise as well because the owner must spend money and time finding a new tenant, and they will not be collecting rent while the process is ongoing.

New markets and CAP rates

CAP rates can also help you figure out what a good market is for investing. You may be able to tell if a market is worth looking into based on the CAP rates. If you are looking to make the most money you can on the money you invest, you want a high CAP rate. If you are looking for long term plays that may have high appreciation, you may want low CAP rates.

While common sense says that you will make more money with a high CAP rate, there are also reasons why CAP rates are high. The higher the CAP rate, the more risk. The market, the property, the tenant, or another factor may be very risky causing that high CAP rate. Some people are okay with risk, and others are not.

How to add value to commercial properties

I have bought a number of commercial properties that were good deals for a variety of reasons.

- Vacant properties

- Properties that needed repairs

- Properties that were under rented

- Properties that were not marketed well

Most of these properties did not have a lot of people considering them because they had something wrong with them. The CAP rates showed what the value was, but the CAP rates also created an opportunity. If you can buy a property at a 7 CAP and raise the income, you can greatly increase the value of a property.

For example:

- A property that makes $100,000 a year at a 7 CAP is worth $1,428,571

- A property that makes $150,000 a year at a 7 CAP is worth $2,142,857

$50,000 is $4,166 a month. By increasing the income on a property by just over $4,000 a month, we have increased the value by $700,000!

There are a number of ways to increase income. You can raise rents, manage the property better, increase the NNN, lease a vacant unit, etc. On one of my properties, we have increased the value by about $2 million dollars by adding two tenants and raising rents.

When not to use a CAP rate

If you want to know the exact return on a property, the CAP rate may not be the right tool. If you are using a loan of any kind, the CAP rate will not help you at all. If you are making repairs or improvements, the CAP rate will not tell you what return you are getting on that money. The CAP rate can be a piece of the puzzle to let you know what the property will be worth, but there are many other numbers to look at.

Conclusion

The cap rate and NOI can be used to help determine the returns on rental properties, but there are also many other factors to consider, like the cash flow and cash-on-cash returns. When looking at CAP rates, make sure the numbers are correct! They could be off in your favor or against you. When you understand how CAP rates work and to use them to your advantage, you make a lot of money in real estate.

InvestFourMore Cap Rate Calculator

My book, Build a Commercial Real Estate Empire, teaches you how to buy, finance, find, repair, manage, and value commercial real estate. It comes with more than 10 case studies that go into the details of deals I have done over the last 3 years, including the good, the bad, and the ugly. If you have any interest in commercial real estate—not multifamily residential apartments—but retail, industrial, and office space, this is the book for you!

Join me on The $100M Mission!

Get exclusive updates as I work to own $100M real estate by 2030 in today's market. Whether you're just starting out or already investing, you'll get actionable insights from my real-world deals and setbacks.

Plus, I'll help you set and achieve your own ambitious goals. Transform your financial future - subscribe now for weekly updates.

Together, we'll prove that massive success in real estate is still possible.

Good info!

I can only make sense of acquiring a 6 cap investment property, if I can build additional units and/or increase gross potential revenue in the double digits.

Exactly

Nice Blog. Thanks.

thanks!