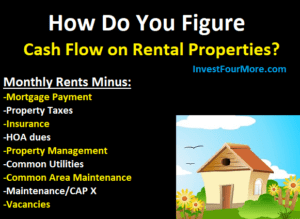

Rental Property Cash Flow Calculator

This calculator figures your real cash flow. It uses mortgage payments, taxes, insurance, property management, maintenance, and vacancy factors. Not only does it allow you to enter your maintenance and vacancies into the calculator, but it also gives you a table with suggested values based on the age and condition of the home.

The calculator provides three categories for conditions based on homes being in ready-to-rent condition. This calculator will give you a great idea of what the actual cash flow will be on your property.

Maintenance Estimates

| Newly Updated* | Some Updating* |

Average Condition**

| |

| 0-10 years old | 5% | 10% | 15% |

| 10-50 years old | 10% | 15% | 20% |

| 50 plus years old | 15% | 20% | 25% |

- Including structure, appliances, and systems

** Condition as compared to homes of similar age

Vacancy Estimates

| Single-Family | 5% |

| Multi-Unit | 10% |

| College Rental | 10% |

The video below shows you how to use the calculator:

Instructions for the calculator

- You will need to reference two tables for Maintenance and Vacancy values. These tables are below the calculator.

- For mortgage rates, we have provided a link to Bank Rate’s mortgage information

- To figure taxes and insurance we have provided links to Zillow. Simply search for your target property or one similar. Scroll down to the property details and you will find estimated tax and insurance values. Cells highlighted in green will show your results.

Additional calculators for rental properties and house flipping

Once you have determined your cash flow, you can use the cash-on-cash return calculator to see what return that cash flow is giving you on your cash invested. You can see how much cash you are making on the cash you invested.

If you are thinking of flipping houses, the 70 percent rule can help you decide how much to pay for a flip. I have a fix and flip and calculator here: Fix and flip calculator.

We have a CAP rate calculator here: Cap Rate Calculator.

We also have a 1031 Exchange calculator that lets you know how much in taxes you will save by doing a 1031 exchange: 1031 exchange calculator.

If you are looking for a more in-depth calculator, check out my review on Rehab Valuator.

Why is cash flow important?

I am a strong believer that cash flow is the most important part of investing in long-term rental properties. Appreciation is nice, but you can’t count on appreciation. If you have plenty of cash flow, then you can survive a drop in prices and appreciation is a bonus.

How does the calculator work?

This calculator accounts for the expenses you will encounter when owning a rental property. There is much more to consider than just mortgage payments, taxes, and insurance. To get an accurate idea of cash flow you need to consider maintenance, vacancies and property management if you are not going to manage the homes yourself.

How to account for maintenance

It can be difficult to account for maintenance when calculating cash flow because all properties are different. Some properties are newer, some are older, some are remodeled and some aren’t. The older the home, the more likely it is that there will be more maintenance needed.

I tried to account for maintenance costs by creating a table with different percentages of maintenance needed based on the age and condition of a home. I created three property condition categories; newly updated, some updating and average. I figure any home that is going to be rented should be in average condition or better. An average condition would mean the house is in decent shape, but may not have been updated for ten years and has aging systems like hot water heaters or a furnace. Some updating would mean the home has mostly new systems, but might not be completely remodeled and has some aging systems. Newly remodeled means the home has been recently built or almost everything has been replaced and redone in the last year or two.

The custom maintenance table couples the condition of the home with the age of the property to give you a percentage of the monthly rent to use for maintenance. The newer the home, the less maintenance needed.

How to account for vacancies

Vacancies are hard to figure because every area has a different rental market. A basic figure to use is 10% of the monthly rent as vacancies. Your vacancy amount can be much higher than this if you invest in an area with a lot of turnover. Remember if you have a house vacant for a month, you also have to pay utilities for that month as well as missing rent payments.

For multifamily properties, I increased the percentage for vacancies because they typically have higher turnover than single-family homes.

How much does a property manager cost?

Property management fees also vary by region and town. Many companies charge 10% of the rents for property management, some charge 12%, and some charge leasing fees as well. We used 12% as our default rate because we assume you could find a property manager that charges 10% with some leasing fees as well. You can adjust this value up or down if you know what your management costs will be.

Figuring taxes and insurance

The tax rates should be fairly easy to find for properties if they are listed online with a local assessor or treasurer. If not, Zillow gives an estimate for taxes and insurance. Zillow is not always accurate, but this will at least give you an idea on those costs. Remember if you already have a mortgage in place or a good faith estimate from a lender, they may have included your taxes and insurance into your payment.

Figuring your mortgage payment

A mortgage payment is not a simple formula to figure because you have to account for principal and interest on an amortized loan. We have provided a link to bankrate.com that will provide you with your mortgage payment based on the loan amount, interest rate and the length of the loan.

If you have a loan with mortgage insurance, be sure to add this amount to the mortgage payment. Mortgage insurance is common on loans that require a down payment of less than 20%. check out this article.

Other costs to consider

Depending on what type of property you own, you may have to pay utilities, HOA dues, snow removal or other costs. All costs need to be considered when calculating cash flow. I hope you enjoy the calculator and can put it to good use!