A Beginners Guide to Buying Your First Home

Last Updated on March 29, 2023 by Mark Ferguson

I have been a real estate agent, broker, investor, and blogger for many years. I have seen many people make huge mistakes when buying or selling homes, and I have seen many people make a killing. The more time you put into learning about real estate, the better off you will be.

How does buying and selling a house work?

A real estate transaction may seem pretty simple: the buyer pays money for a house, and the seller takes money for a house. However, the buyer has to get a loan, make sure the home is in the condition they think it is in, and avoid significantly changing their ability to qualify for a loan. The seller has to make sure they negotiate in good faith, are not trying to hide anything, and are willing to work through any issues with the inspection or appraisal. Here are the basic steps that occur in most real estate transactions:

Seller preparation

- The seller lists their home with a real estate agent so that they can sell it quickly and for the most money

- The seller makes sure their home looks great and is priced well

- The seller discloses any problems with their home that they know about

Buyer preparation

- The buyer finds a real estate agent to help them find homes for sale

- The buyer qualifies with a lender to see how much they can afford

- The buyer looks at homes with their agent until they find one they like

- The buyer makes an offer on the home they want to buy

The contract

- The seller reviews the offer and decides if they want to accept it or counter it (change price or terms)

- The seller and buyer come to an agreement and sign the contract (when the contract is signed by both parties, it is called going under contract)

- The buyer pays earnest money to secure the contract (usually this is refundable under certain conditions)

Due diligence

- The buyer completes an inspection on the home to see what condition it is in

- The buyer and seller negotiate any items to be fixed or price changes after the inspection

- The buyer’s lender completes an appraisal on the home to determine the value

- The buyer and seller negotiate or try to fix any problems with the appraisal

- The buyer waits for their loan to be approved

Closing

- The buyer and seller go to closing where the house deed is transferred from the seller to the buyer

- The seller has hopefully moved out by now and the buyer can move in.

The video below also goes over how the process works.

What are some common real estate terms?

As a real estate professional, I sometimes forget that not everyone knows what all the real estate terms mean. Many real estate agents, lenders, and other professionals may forget as well. Do not feel dumb if you do not know all the terminology when working on a real estate deal. Here are the definitions of some of the more common terms:

Earnest Money

Earnest money is the deposit that is paid by the buyer when they make an offer on a house. In most states, the earnest money is refundable based on certain contingencies in the contract. The buyer may be able to complete an inspection or wait to make sure their loan is approved before they risk losing their earnest money. The earnest money is often held by the title company or closing company.

Title company

Most states use title companies to complete the transfer of the property deed and make sure the seller has clear title. The title company will complete a title search to find out what liens are owed by the seller and make sure those are paid off before the title is transferred to the buyer. The title company will also provide title insurance for the buyers, which partially guarantees all the liens were paid off. Some states will use attorneys to complete the closing and do title searches.

Inspections

Most contracts will include a clause that allows the buyer to inspect the house before they purchase it. Most buyers will hire an inspector to check out the house and see if they can find any problems. There is usually no guarantee provided by the inspector because they cannot see into walls or know everything that could be wrong with a home.

Appraisals

An appraisal is a report completed by a licensed appraiser that gives a value on a property. The appraiser is usually hired by the buyer’s lender to make sure the house is worth at least as much as the buyer is paying. With certain loans, the appraiser will also make sure the home is in a livable condition.

The video below goes over appraisals in more detail.

Contract/under contract/in escrow

When a buyer makes an offer on a home, their agent creates a contract that the buyers sign. That contract is an offer until the seller accepts it or counters the offer and the buyers accept the counter. When the buyer and seller agree to terms and sign the contract, it is commonly called going under contract, and agents will refer to the home as being “under contract” or “in escrow” depending on the state you live in. When a house is under contract, no other buyers may purchase it unless the first contract falls apart because one of the parties backed out or did not live up to the terms in the contract.

Property disclosure

The seller is required to disclose any material facts they know about the home. In some states, the seller is required to fill out a property disclosure, and in other states, they are not. No matter if they are required to fill out the form or not, they are still required to disclose material facts. Material facts are physical items wrong with the home that could greatly affect the value or functionality of the home. If the sewer line is broken, the seller would have to tell the seller.

I go over many more real estate terms in a glossary I created.

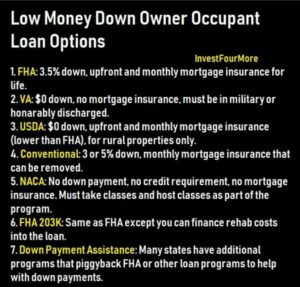

Are there special loans for buying your first home?

Many people think that first time home buyers get special loans, but the truth is most loan programs work for buyers whether they have never owned a house or owned 20. Low-down-payment loan options are available to owner-occupant buyers, not just first time home buyers.

There may be some special grants or down payment assistance programs for first time home buyers that are local to your are, but don’t think you cannot get a great loan just because you have already owned a home before. It does get tricky finding low down payment loans if you are buying an investment property.

How does the buyer qualify for a loan on a home?

When someone is interested in buying a home, one of the first things they should do is talk to a lender. The lender can pre-qualify a buyer, which means they check the buyer’s credit, income, and background for foreclosures or bankruptcies. If you are a buyer, do not lie to your lender! The lender will find out eventually, and it will kill the deal if they do not find out until you have a home under contract to buy.

The buyer has to have a certain credit score to get a loan, which can be as low as 550 for some loans or as high as 720 for other loans. The lender can tell you what score you need for the type of loan you are getting. If the buyer needs a credit score of 620 to get a loan, their score must be 620 at the time they buy the house, not just when they qualify. Some of the biggest mistakes I have seen involve a buyer doing something to change their credit score right before they buy a house.

- When you apply for credit, your credit score will be pulled. If your credit score is pulled too many times in a certain amount of time, it can reduce your credit score. Even if you just apply for a car loan, it might reduce your credit score low enough so that you cannot qualify for your loan anymore.

- You must work at your current job or at least be in the same field for the work you are doing for at least two years to qualify for most loans. If you were a truck driver for 30 years but then quit your job to sell insurance, you may not qualify for a loan until you have been an insurance agent for two years. If you quit one insurance agency to join another, it most likely will not change your ability to qualify because you are staying in the same line of work. If you quit your job or change fields right before closing on a house, it could cause you to kill the deal if the lender finds out. The same goes for retiring right before buying a house.

- Your income must be a certain amount compared to your debts to qualify for a loan. If you take a loan to raise your debts or reduce the hours you work before you buy a house, it could cause you to not qualify for the loan anymore.

- Sometimes, paying off debt can hurt your credit! It would seem like common sense that paying off debt would help you qualify for a loan, but that is not always the case. Some loans require a buyer to have a certain amount of cash in the bank, and if they use that cash to pay off debt, it may hurt their ability to get a new loan. Some debt will also help your credit.

When a buyer is getting a loan on a house, they need to tell their lender everything! Do not try to hide a new purchase or pay off debt without asking your lender first if it will hurt your chances of getting a loan. The lender will pull your credit and check everything before the closing.

Here is a great article with some advice for first-time homebuyers.

What are some issues that can cause a deal to fall apart?

Once a home goes under contract, there are many things that can cause that deal to “fall apart.” The buyer must get past the inspections and get their loan approved.

The buyer’s loan

I see many deals fall apart, and the biggest problems come from the buyer’s loan, the inspection, and the appraisal. Lenders can be very picky about who they lend money to and have strict guidelines for:

- Credit score

- Debt to income ratio

- Income

- Time at their current job

- Previous foreclosures or bankruptcies

The buyer’s lender should look at all of these items before they qualify the buyer for a loan. The buyer should also get qualified before they look at any houses. If the lender does not do a good job of qualifying the buyer or any of these items change while the buyer is trying to buy a house, it can kill the deal.

There are great lenders and really bad lenders. I have seen lenders not find a bankruptcy until a week before closing, which killed the deal. Not all lenders are equal!

The condition of a home

If the seller fixes something that was broken, they may not have to disclose that there was ever anything wrong with that item. Along with the seller providing any known information on their house, the buyer usually gets a home inspection. The home inspection involves the buyer or someone the buyer hires looking at the house to see what condition it is in. Home inspections kill many deals because the buyers find problems with the house, and they cannot come to an agreement with the seller to fix the items or change the price.

Along with an inspection, almost all lenders will require an appraisal to be completed. The appraisal is a report completed by a licensed appraiser, which gives a value for the home and mentions any problems with the home that may cause it not to qualify for a loan. The appraiser is not looking at the house as close as the home inspector, but he is looking for obvious problems with the roof, heating, foundation, electric, plumbing or other major systems.

Negotiating inspections objections

The inspection is usually done before the appraisal on most real estate deals. The home inspector goes through the entire house and creates a report that lists any problems he sees with the home. The inspector usually does not guarantee anything he reports on unless the buyers pay an extra fee. The inspection can cost from $250 to $500 depending on the size of the home. If you want to get a guarantee from the inspector, it can easily double or triple the cost. Here are some mistakes I see buyers make with inspections:

- The buyer asks for everything to be fixed on an inspection report. The inspection report might include every minor deficiency, including missing outlet covers. The more a buyer asks for, the smaller the chance there is the seller will agree to fix things. The buyer should try to ask for the major expensive items on an inspection report and be willing to fix the minor issues themselves.

- The buyer does not understand how serious problems are. Some inspectors will list all the code violations on a home. Code violations sound serious, but the building code changes over the years, and almost all older homes will have code violations. The trick is knowing if the code violations are serious or dangerous. The best way to handle code violations is to ask a professional in that field. If the home has electrical code violations, ask an electrician how serious they are and if they are dangerous. It can be very expensive to fix all violations and could very easily kill the deal.

- The buyer freaks out when they see the inspection report. There are going to be problems with every house, even brand new homes. I have had inspections done for clients on new construction that even showed code violations even though the city inspected the home and said it was okay. It can be overwhelming to see how many things are mentioned on an inspection report, and some buyers want out without analyzing the report. Don’t be scared when you first see the report, but you must be willing to go through it to see how serious the issues are. Don’t be afraid to ask the seller to fix most of the problems if that is the only way you feel comfortable buying the home.

Some sellers can also cause a deal to fall apart by refusing to negotiate. Some sellers will risk losing thousands of dollars because they don’t want to spend $500 to fix a furnace, which any buyer will want done. When a seller has to put their house back on the market, it will usually sell for less than if the first deal went through. It can also take months to get a home under contract again, which can also cost the seller a lot of money.

It usually makes sense for the seller to fix some inspection items or even lower the price of the home to save a deal. It sucks making less money than you thought you were going to make, but in the end, the seller needs to make the most money they can, not let their egos get in the way of common sense. The seller should also have an idea of what repairs might be called out from the appraisal.

To learn how to get the best deal and make the most money, check out my book: How to Buy a House: What Everyone Should Know Before They Buy or Sell a Home. It is on Amazon as a paperback or Kindle.

Negotiating appraisal issues

The appraisal on a home is done after the inspection is completed. The appraisal is ordered by the lender and is meant to confirm the house is worth as much as the contract price to protect the bank. The appraisal can also be used to confirm the house is in livable condition. Here is an example of what would happen if the appraisal comes in too low.

- You are buying a house for $200,000 with a 5 percent down payment. That means you have to put down 5 percent or $10,000 in cash, and the bank will finance $190,000 of the house (you will also have to pay closing costs which could be 2 to 4 percent of the loan amount).

- If the house appraises for $200,000, the lender would base their loan off $200,000 and lend you $190,000.

- If the house appraises for $190,000, the lender would base their loan off $190,000 and only lend you $180,500. Instead of having a $10,000 down payment, the buyer would need a $19,500 down payment.

When an appraisal comes in low, it can cause many problems since the buyer may not have the extra cash to put down. One option is to have the seller lower the price of the home to $190,000, which is great for the buyer but not so much for the seller. The seller could choose not to lower the price, but the buyer may cancel the contract, and the seller would have to put the home back on the market. If the buyer was using an FHA loan, that appraisal has to be used for the next 6 months, which means the seller would have to find a buyer using a different loan to sell the house for more money. If the buyer can come up with a little more cash and the seller can lower their price, that may be a win-win for both parties.

Another issue with appraisals is the condition of the home. If the home is not in livable condition, many lenders will not loan the buyer money to buy it. Livable condition usually means the heating system, plumbing, electrical, roof, and foundation are all in working order. There also cannot be holes in the walls, floors, or other major problems with the home. If the appraiser sees any problems in the house, he will call them out on the appraisal. The lender will see those problems and usually requires them to be fixed before closing.

If the seller knows there are problems with the home that will prevent financing, they should fix those problems or accept an offer that is cash or using a loan without the livable condition requirement. Buyers should also be aware that they may have problems getting a loan if the house needs a lot of repairs and the seller is not willing to fix them. If the seller wants to make the most money, they should fix any problems that would prevent financing. They will greatly limit the buyer pool if the house can only be bought with cash.

Why you should always use a real estate agent:

How can the buyer and seller make sure their deal goes smoothly?

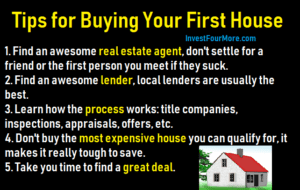

Most buyers and sellers don’t take much time to learn about the house selling process, even though it is most people’s largest purchase that they will ever make. Buying or selling a house can be overwhelming. As you saw in the first part of this article, there are a lot of components to the process. If you take the time to learn the most important parts, it will save you a lot of money and headaches. The best thing a buyer or seller can do to make the process go smoothly is to hire good people. Hire a great real estate agent, and hire a great lender.

A great agent and lender will handle all of these issues for you, but the trick is knowing if you have a great agent or lender. If you don’t know anything about buying a house, you could have the worst agent in the world but think they are great because you don’t know any better. The more you know about buying houses, the better the person you can hire to help you. If you know the main components of buying or selling, you can also tell if someone you hire is doing a bad job.

Do you need a real estate agent?

A lot of people think they can save money by selling a house themselves, but that is not usually the case.

Since the seller typically pays for the real estate agents for both the buyer and seller, it makes sense for the buyer to have an agent represent them. One of the most important things a great real estate agent can do is recommend a great lender. A bad lender is the fastest way to cost yourself a lot of money and kill a real estate deal. A great agent can also tell you if the lender you are using is any good or not. It is usually better that you use local lenders who are experienced in completing loans in your area. We have really bad luck with out-of-town lenders, especially online national lenders. They don’t know the local customs well, how long it takes to hire an appraiser, how the title companies work, etc.

- There is one bank in our area where almost every appraisal comes in low. We are pretty sure the bank pressures their appraisers to value homes low because we don’t have the same problems with other banks.

- There was another lender who missed a bankruptcy a buyer had within the last two years. The worst part was the lender did not catch it until a week before closing when it should have been caught in the qualification process.

- Other lenders have waited three weeks to order an appraisal when it takes at least three weeks to get an appraisal done in Colorado thanks to a shortage of appraisers. That delayed the closing by two weeks!

Good real estate agents will have lenders they have used for years in the area you want to buy a home in. They should also give you a couple of choices so you can pick the lender you are most comfortable with.

A good real estate agent will also recommend a good home inspector. Some home inspectors will spend hours and hours on a home and list every possible thing wrong. This may seem like a great deal for the buyer, but you need an inspector who can tell you how serious the problems are. Some inspectors make it seem like a house is about to explode it has so many problems when the issues are minor and can be fixed. Other inspectors may miss major problems because they are laid back or not trying very hard. The trick is finding an inspector who will find the issues but be able to explain how serious the problems are. A lot of deals are killed because inspectors scare buyers over minor issues.

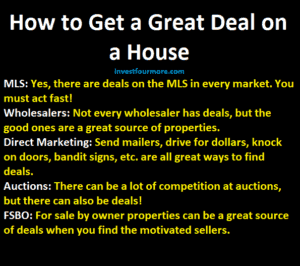

How to get a great deal

Many home buyers are not trying to get a good deal. They don’t want to pay too much for a home, but they also are not trying very hard to learn values or buy below market value. It is not easy to learn how to flip houses like I do because you really have to get an awesome deal. However, that does not mean most people can’t get a really good deal by being patient and flexible with their purchase criteria. The most important thing a buyer can do is learn market values in their area so they know what a good deal is. A really good real estate agent should be able to help a buyer with valuing properties. A really good agent should also be able to act very fast to help a buyer get a great deal when they see one come on the market.

Conclusion

Buying or selling a home is a complicated process. That is why real estate agents still exist. We did not even get into the process of writing contracts and the paperwork involved. Even though real estate agents can help you buy a home, the more a buyer or seller knows about the process, the better deal they can get or the more money they can make.